Recent Posts

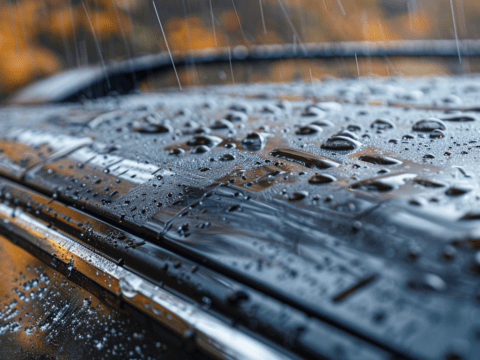

3 Signs You Need to Replace the Weatherstripping on a Car

Weatherstripping is a part of your car that you may not give much thought to, but it does a very…

5 Benefits of Having a Wrapped Vehicle for a Franchise Location

When it comes to opening your own franchise, it can be a very rewarding yet challenging time. Over the course…

7 Tips for Keeping Your Fishing Supplies Organized in Your Car

Heading out for a relaxing day of fishing can quickly become not-so-relaxing when you have a mess of supplies in…

Understanding Cargo Insurance for Commercial Trucks

There are a few different types of insurance that are utilized by commercial trucks to protect against all sorts of…

Safety Tips for Motorcyclists

According to a study conducted by the National Highway Traffic Safety Administration (NHTSA), 5,932 motorcyclists lost their lives in motorcycle…

Window Tinting: Worth the Investment?

Window tinting, a practice that become popular in the ‘70s, has become more than a style statement; it’s a practical…

Tips for Maintaining Your Car’s Resale Value

For many, purchasing a car is one of the most significant investments they’ll make. Whether it’s a sedan, a SUV,…

Advantages of Using a VIN Decoder

Understanding the intricacies of a VIN can provide invaluable insights into a vehicle’s past, making a VIN decoder an essential tool for buyers, sellers, insurers, and automotive enthusiasts.

Can you get cheap WoW gold?

World of Warcraft (WoW) is a name that resonates with millions around the globe, encapsulating a vast and intricate world…

Preventative Measures: How Regular Maintenance Can Help Mitigate Liability in Car Accidents

In the hustle and bustle of everyday life, it’s easy to overlook the importance of regular vehicle maintenance. Many of…

Should You Upgrade Your Vehicle’s Brakes?

Brakes are one of the most critical components of any vehicle, responsible for safety and control. As car enthusiasts, we…

6 Tools You Need in Your Garage if You Want to Do Your Own Car Maintenance

Considering that the average age of a passenger vehicle in the U.S. is 12.5 years, you should think twice before…

Plan for Emergency Car Expenses to Avoid Financial Roadblocks

As a car owner, it’s crucial to be prepared for unexpected expenses that may arise. From sudden breakdowns to pricey…

How Do You Deal with Evolving Customer Demands in the Food Delivery Industry?

To succeed in today’s highly competitive market, you have to understand what your customers want. There has been a significant…

5 Common Myths About Truck Accidents

Navigating the aftermath of a truck accident can be daunting, compounded by prevalent myths that can mislead and confuse victims…

Safeguard Your Car: Benefits of Paint Protection Film

Welcome to our guide on the benefits of paint protection film. When it comes to keeping your car looking its…

Mercedes-Benz in the World of Gaming: From Virtual Cars to Real-Life Performance

Mercedes-Benz’s presence in the dynamic realm of gaming represents a fascinating fusion of virtual excitement and real-world performance. As one…

What Every Driver Should Know About Car Insurance

Navigating the world of car insurance can be as complex as it is crucial. With roads becoming busier and driving…

Arch Discusses Securing Assets: Inside the World of Crypto Vaults

The digital age has brought a wave of innovations, including the rise of cryptocurrencies. As these virtual currencies gain prominence,…

Benefits of Junk Car Removal for Cities

Urban landscapes are constantly evolving, striving for efficiency, beauty, and sustainability. Amid this evolution, junk car removal emerges as a…